by Guest Writer KRISTINA BRUCE | CLEARNFO.com | July 16, 2015

The housing crash of 2008 wiped out over $6 trillion dollars in American assets and dropped household net worth by almost 40%. Not only that but the banking debacle also cost an additional $26 trillion in bailouts and another $3.6 trillion in Quantitative Easing. The latter was to keep interest rates low in an attempt to jump-start housing sales. We’ve frequently seen mention of the repeal of the Glass-Steagall Act (GS) as the mechanism which could have averted the banking crisis and it’s making headlines again as a bill originally introduced in 2013 by the unlikely duo of Elizabeth Warren (D-MA) and John McCain (R-AZ). It seems the memories of the American public like goldfish aren’t very long because what’s old seems to be new again.

The housing crash of 2008 wiped out over $6 trillion dollars in American assets and dropped household net worth by almost 40%. Not only that but the banking debacle also cost an additional $26 trillion in bailouts and another $3.6 trillion in Quantitative Easing. The latter was to keep interest rates low in an attempt to jump-start housing sales. We’ve frequently seen mention of the repeal of the Glass-Steagall Act (GS) as the mechanism which could have averted the banking crisis and it’s making headlines again as a bill originally introduced in 2013 by the unlikely duo of Elizabeth Warren (D-MA) and John McCain (R-AZ). It seems the memories of the American public like goldfish aren’t very long because what’s old seems to be new again.

Was Glass-Steagal actually doing the job of protecting the public from the evils of retail and investment banks interconnectedness, collusion and risk taking when it was still in place? No it wasn’t. Enacted in 1933, by the time a portion of it, yes only a portion was repealed in 1999 with the passage of the Gramm-Leach-Bliley Act, the banks had long been involved in the very same activities which are once again being blamed for creating the crisis. Pay no attention to the fact that GS regulation would have had no effect on the failures of Bear Stearns, Lehman Brothers, Merrill Lynch, AIG, Fannie Mae nor Freddie Mac. Oh and please ignore the fact that in 2004 the SEC decided to raise banks debt-to-capital ratio from 12:1 to 30:1. Surely that had no effect on how much more risk they were able to take on. Right? No it was all Glass-Steagall the politicians proclaim!

The reality is that Glass-Steagall stopped doing anything to protect anybody at the very latest in the era of Harold Geneen and International Telephone and Telegraph Corp (ITT). Why this reference? Because that was sort of the most famous example of a wave of large mergers and acquisitions which certainly showed up in the finance sector around that time. It didn’t take nearly as long to recognize in the business sector how very destructive the way Geneen gobbled up companies into IT&T was, to form this weird conglomerate of unrelated businesses. Eventually it destroyed the core business and that is what people should keep in mind as we go down the rabbit hole. Hands in too many pies eventually lead to big mistakes and malinvestment.

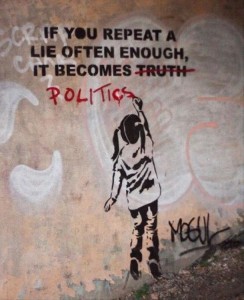

The point of that example is to compare it to the reunification of the finance sector which began around the same time and it soon got to a point that commercial banks, investment banks and proprietary trading banks had no separation that could be overcome no matter what the goofball regulators did and we’re talking the 1970’s here! Forty years ago not; even in this century! It had been going on for so long that by 1999 it was argued Glass–Steagall was already “dead.” One of the latest incidents before GS was repealed was Citibank’s 1998 affiliation with Salomon Smith Barney, one of the largest US securities firms, was permitted under the Federal Reserve Board’s then existing interpretation of the Glass–Steagall Act. They just did whatever the hell they wanted to and they’ll do it again. It was not long after Citibank/SSB that Clinton publicly declared “the Glass–Steagall law is no longer appropriate.” All they did was once again codify illegal behavior by changing the law just as the current administration has codified all sorts of illegal acts through the National Defense Authorization Act, The Federal Grounds Protection Act, continually extending the Patriot Act, the Freedom Act and this horrid upcoming Trans Pacific Partnership (TPP) trade agreement. They tell you that they’re protecting you then they change the law to benefit the banking corporate cartel and also strip you of your rights.

What’s more is that the politicians are being disingenuous and playing on the naiveté of the public when it comes to both their short memories and lack of attention as to how the banking industry works. In Warren’s opinion as stated in a New York Times article from 2012; when asked if GS had been in place at the time of the financial crisis if it would have averted it or reduced banking loses, her reply ;

“The answer is probably ‘No’ to both.”

Andrew Ross Sorkin who did the interview summed up Warren’s motives for pushing GS reinstatement at the time hit the nail on the head:

“In my conversation with Ms. Warren she told me that one of the reasons she’s been pushing reinstating Glass-Steagall — even if it wouldn’t have prevented the financial crisis — is that it is an easy issue for the public to understand and “you can build public attention behind.”

She added that she considers Glass-Steagall more of a symbol of what needs to happen to regulations than the specifics related to the act itself.”

Bingo! It resonates with the populace. It makes them feel as though someone is actually doing something even if it is meaningless. It’s pandering.

Is there more to this though? Is there possibly something here from which the banks might actually benefit? I think there is. Pandering alone is not usually motive enough for politicians like McCain who is so entrenched they’ll probably remove him from the senate in a body bag or Warren who has already become so popular that her political career is almost ensured for as long as she desires to remain in the senate.

What happens if the new and improved GS 2.0 is passed? Well within 5 years the retail banks will have to divest themselves of all activities deemed exclusive to investment banks and vice versa. In some cases the government will also reserve the right to force cessation of certain activities in an even shorter time frame where it feels there is imminent risk to the public. That means a lot of shifting of business will have to be done in a very short matter of time. Do you reckon that retail banks are just going to hand over that portion of their business to investment banks and the investment banks will do so in kind? Not likely. On top of that, there are portions of assets each hold which neither would even want to dirty their hands with.

It is likely that toxic assets are becoming so burdensome and eminently destructive that the major banks would actually welcome a superficial break-up at this point. It would give them an opportunity to spin some of the absolutely worthless portions of the $1.2 QUADRILLION holdings of completely unregulated derivatives market. This of course would be shoveled into smaller entities which could later be allowed to implode and without implicating the parent companies. It would also give them plausible deniability for the offload if it was government mandated too!!!

They’ve got $TRILLION$ in bad derivatives bets which are going to eventually go sour no matter how much money they print and infuse the banks with. There’s a global economic slowdown and a currency devaluation war going on right now which ensures it’s going to happen at some point in the not too distant future. You bet your bottom dollar they’d love to get a huge portion of that off the books sooner than later! If they spin-off these toxic assets themselves everyone’s going to blame Goldman Sachs, Chase, HSBC and myriad other “too big to fails” for having done so. If government *snickering* “forces” them to become smaller, then the heat is off the parent entities when these bets do go bad for their spun-off children.

It doesn’t matter a whit if these banks create new separate entities to handle portions of business they will be precluded from engaging in. Most of what will be spun off are bets on junk and holdings in the grossly overvalued stock market; which is becoming more and more difficult to prop up, not just here in the U.S., but globally. The Chinese stock market was falling so precipitously that last week the government had to place stringent controls on selling by major holders for the next 6 months. They initiated discounts on transaction fees and decreased margin requirements to encourage buying. At the same time the NYSEX was halted for half a day which still is somewhat mysterious. At the same time the Euro zone is in a tremendous mess with Greece, which if it doesn’t go Germany’s way could set off a domino effect of similar defaults and send their markets into a tail spin. Doesn’t it seem awfully convenient that simultaneous to this all of the sudden, a 2-year-old bill which had been lost in the shuffle is suddenly in vogue again? The banks want to take out the trash and this is the perfect cover to do it under.

The general populist cry is understandable. The banks are robbing them blind and they want it to stop. The problem is that Glass-Steagall isn’t going to do much of anything other than give the banks an opportunity to stick it to them again. Say it publicly though and most folks’ hair bristles and spit flies out their mouths as they scream, “It’s better than nothing!” They want so badly to believe that some politician somewhere is doing something, ANYTHING on their behalf that when you gore the sacred ox of Glass-Steagall they lose all logic. The problem is that economics is a dismal science which even a goodly portion in the industry of trading and finance don’t fully understand. How are we to expect a public whose economic education on the subject generally amounts to the cumulative sound bites they’ve heard on the evening news and a blurb or two from the likes of FOX News, MSNBC and their endless parade of bobble head commentators, to really have a grasp on what’s being proposed? At best it will do little to nothing. At worst it may be a Trojan Horse leaving another swath of destruction which the banking industry will casually walk away from relatively unscathed.

Note: The Glass-Steagall Act was enacted in 1933 to limit commercial bank securities activities and affiliations between commercial banks and securities firms. In short it was a wall of separation between commercial and investment banking. The 1999 repeal permitted Wall Street investment banking firms to gamble with their depositors’ money that was held in affiliated commercial banks.

By Guest Writer Kristina Bruce ⋅ July 16, 2015

Read more from Kristina Bruce at Cutting the Gordian Knot